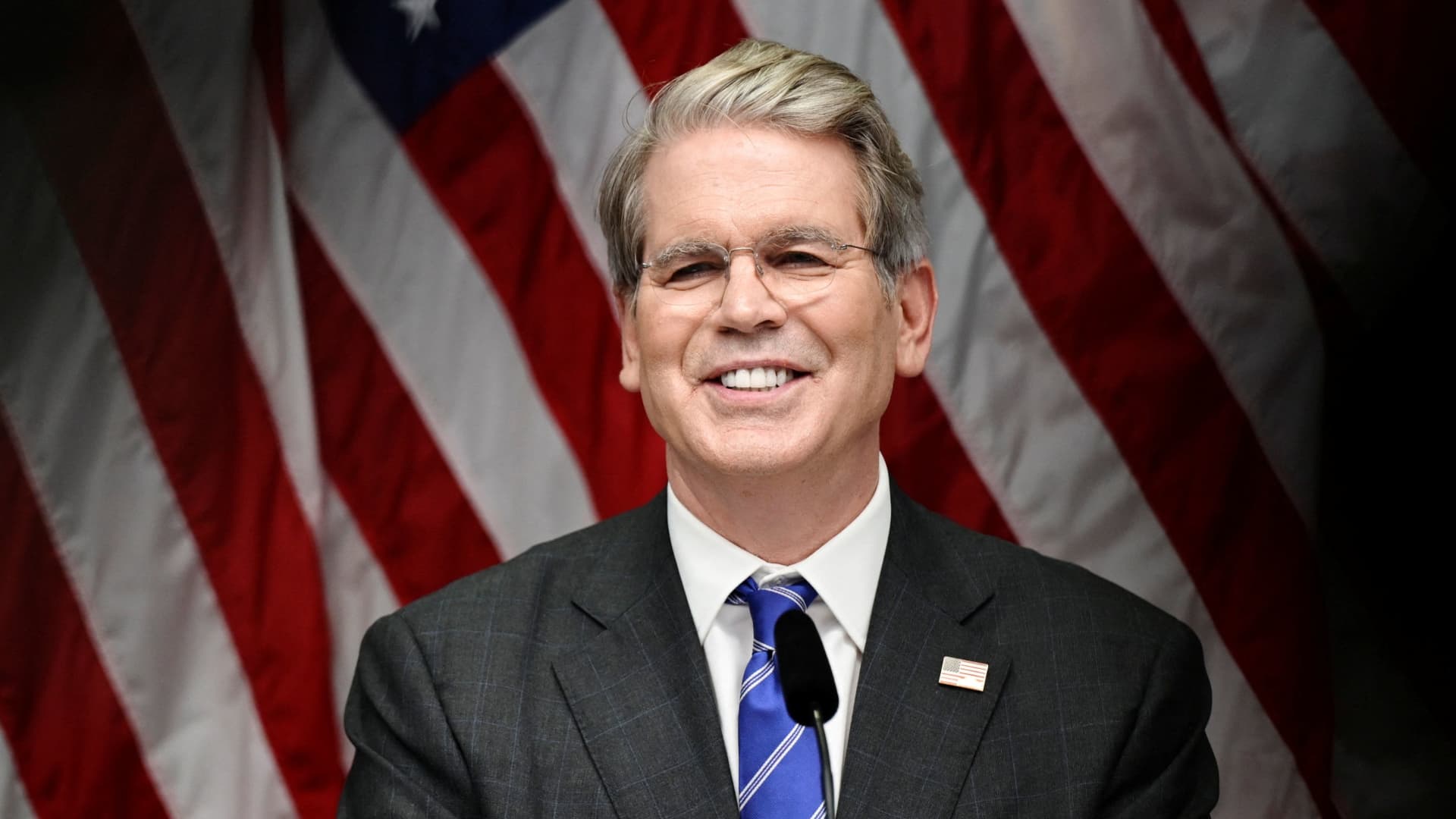

As the looming August 1st deadline for President Donald Trump’s new tariff rates approaches, Treasury Secretary Scott Bessent has urged a cautious optimism, advising investors and businesses “not to panic.” His remarks come amidst widespread apprehension concerning the potential economic repercussions of the impending tariffs, seeking to temper anxieties despite the significant shift in global trade dynamics anticipated by the administration.

Bessent’s message, consistently delivered over recent days, underscores the temporary nature he believes these reciprocal tariff rates could hold. He suggested that while the tariffs might “be on for three days, it may be on for three weeks, it may be on for three months,” nations retain the ability to “continue negotiating” even after the initial implementation. This perspective aims to reframe the deadline as a strategic point within ongoing discussions rather than an absolute end.

These statements align with a broader strategy from the Trump administration, which often employs deadlines and the threat of increased duties as leverage in complex trade negotiations. The intent appears to be pressuring countries to concede to higher tariff rates on their exports to the U.S., while simultaneously opening their domestic markets more broadly to American products, a core tenet of the administration’s “America First” economic policy.

Secretary Bessent clarified that should a country’s tariff rate revert to the level that was initially announced in April, it would undoubtedly draw considerable attention. He emphasized that the Trump Administration views the Aug. 1 deadline as a firm marker, despite numerous nations, including some of the U.S.’s primary trading partners, having yet to finalize comprehensive trade agreements, highlighting the high stakes involved in these discussions.

Looking ahead, Bessent foreshadowed a “busy August,” anticipating an intensified period of global trade negotiations following the Friday deadline. This suggests that the administration is prepared for continued dialogue and adjustments to trade tariffs, indicating that the immediate imposition of rates might be a catalyst for renewed discussions rather than a definitive conclusion to trade disputes.

Despite the Treasury Secretary’s reassurances that these “snapback tariffs” are “not the end of the world,” the prevailing sentiment among investors and businesses remains largely unreassured. Many are already grappling with the complexities of an unpredictable US Economy and adapting to a constantly evolving international trade environment, making any additional uncertainty a significant concern for their bottom lines and future planning.

The unfolding scenario underscores the delicate balance between diplomatic pressure and market stability. While the administration maintains its resolute stance on enforcing its trade tariffs to achieve what it deems fair trade, the private sector’s immediate reactions and long-term adjustments will ultimately define the true impact of these policy shifts on the broader economic landscape.

Leave a Reply