The Federal Reserve recently witnessed an unusual level of internal disagreement regarding its monetary policy, with two governors formally dissenting on the decision to keep interest rates unchanged, a historical event not seen in over three decades.

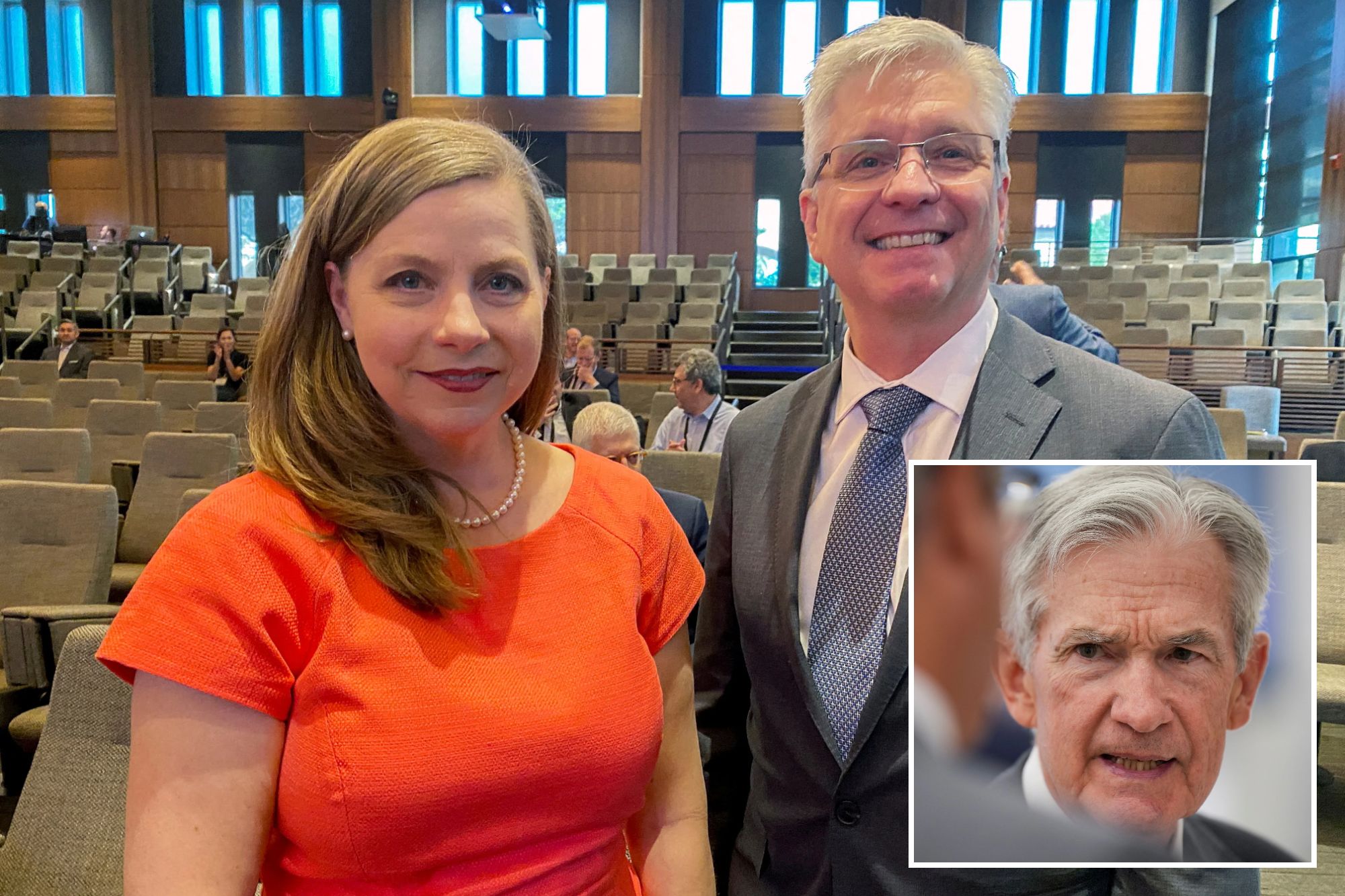

Governors Michelle Bowman and Christopher Waller cast votes against maintaining the benchmark overnight interest rate in the 4.25%-4.50% range. Their preference was for an immediate quarter percentage point reduction, signaling a notable divergence from the majority’s wait-and-see approach to economic policy.

This marked the first instance since December 1993 that two members of the Washington-based Board of Governors formally opposed a decision by the policy-setting Federal Open Market Committee (FOMC). This rare occurrence underscores the significance of their stance within the central bank’s typically unified framework on interest rates.

Interestingly, both Governor Waller and Governor Bowman were appointed to the Fed’s board by the current president, a detail that adds a layer of political intrigue given the president’s past vocal criticisms of Fed Chair Jerome Powell for not cutting interest rates sooner, influencing monetary policy discussions.

Formal opposition from Fed governors is exceedingly rare; historically, most FOMC dissenting votes originate from regional Fed bank presidents. The last governor to dissent was Bowman herself, when she advocated for a smaller rate cut than her colleagues at a previous meeting, showcasing her consistent views on economic policy.

Bowman, on prior occasions, had dismissed concerns about import tariffs potentially fueling inflation, asserting that as long as inflationary pressures remained contained, she believed a rate cut should be considered. This consistency in her views highlights a specific economic outlook within the federal reserve.

In contrast to Waller and Bowman’s immediate rate cut preference, the majority of Fed policymakers have adopted a more cautious stance on the economic and monetary policy outlook. While inflation has shown signs of easing, many officials remain wary that tariffs could reignite price pressures, justifying a more restrained approach to policy easing on interest rates.

Ultimately, dissenting votes within the Fed’s policy committee are often viewed as a healthy sign of robust debate among central bankers, rather than an indication of disunity. Officials frequently emphasize that such disagreements demonstrate a rigorous analytical process and prevent “groupthink,” addressing a common criticism leveled against large, influential institutions like the central bank.

This recent dissent, therefore, not only highlights specific economic policy preferences but also reinforces the perception of the Federal Reserve as an institution where diverse economic perspectives are genuinely considered and debated, even if the final policy decision on interest rates reflects a consensus view.

Leave a Reply