In a significant move that underscores the continued robust investment landscape for promising technological ventures, fintech powerhouse Ramp has successfully closed an additional $500 million in funding. This latest Series E-2 round, spearheaded by ICONIQ Capital and drawing contributions from nearly two dozen other distinguished investors including Alphabet Inc.’s GV fund and Khosla Ventures, further solidifies Ramp’s position as a leading innovator in the corporate finance sector.

This substantial capital injection propels Ramp’s total external funding to an impressive $2 billion and elevates its valuation to a staggering $22.5 billion. Remarkably, this represents an $8 billion surge in less than two months, following a previous $200 million raise in mid-June. Such rapid financial growth highlights the market’s strong confidence in Ramp’s disruptive approach to enterprise software and its potential for even greater expansion.

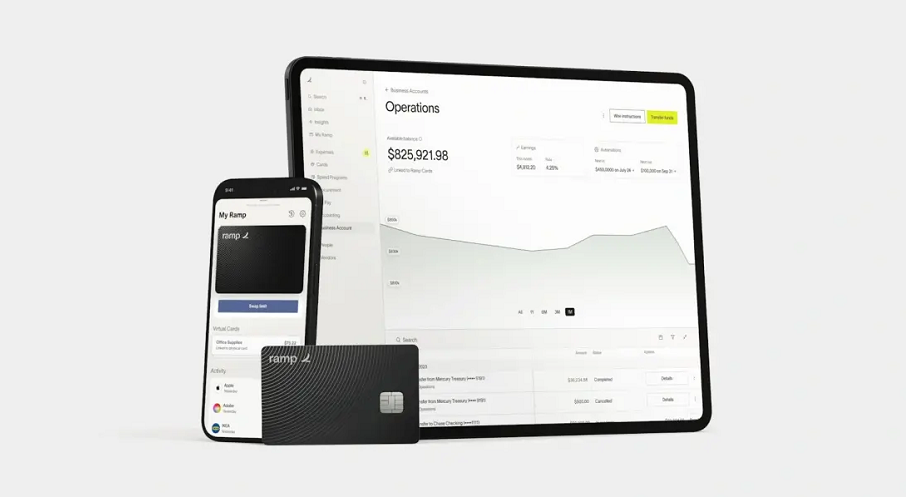

At its core, Ramp addresses the complex and often time-consuming processes of business expense management. Launched in 2019, the company initially gained traction through its corporate credit card offerings, designed to provide comprehensive tools for accounting teams. These tools enable meticulous monitoring of employee purchases and the implementation of supplier-specific spending limits, streamlining what was traditionally a laborious task.

A cornerstone of Ramp’s innovation lies in its advanced AI automation capabilities. The company leverages sophisticated AI agents to autonomously handle the approval of business expenses. When a transaction occurs, these intelligent systems meticulously compare it against internal reimbursement policies, granting approval only if all necessary criteria are met. This cutting-edge application of artificial intelligence dramatically reduces manual work, enhancing efficiency and accuracy for businesses.

Beyond its initial credit card services, Ramp has strategically expanded its product portfolio to offer a more holistic suite of financial solutions. A prime example is the introduction of its Treasury service in January, which empowers companies to establish deposit accounts for managing operational funds and investment accounts offering competitive interest rates. This expansion has seen considerable success, with Treasury already managing over $1 billion in customer funds, demonstrating the breadth of Ramp’s impact on corporate finance.

Furthermore, Ramp provides an array of enterprise software tools specifically tailored for finance teams. These include solutions that automate tedious tasks such as account reconciliation, ensuring the consistency and integrity of a company’s accounting data. The platform also offers procurement tools designed to simplify complex processes like the renewal of software-as-a-service subscriptions, further embedding AI automation into daily business operations.

The company’s rapid adoption and success are evident in its growing customer base, which now includes more than 40,000 organizations. With annualized recurring revenue topping $700 million by March, Ramp is not just growing, but thriving. The company proudly asserts that its automation features have collectively saved its clients over 27.5 million hours of manual work, a testament to the tangible benefits of its AI-driven solutions.

Looking ahead, co-founder and Chief Executive Officer Eric Glyman recently highlighted Ramp’s ambitious future trajectory, stating, “Right now, Ramp users are getting 3x more done per minute compared to two years ago. By 2027 – as our agents start working in parallel – we’re aiming for 30x.” The proceeds from this latest funding round are earmarked to accelerate product development, with plans to introduce new AI agents specifically designed to automate challenging account reconciliation and procurement tasks, reinforcing Ramp’s commitment to continuous fintech innovation.

Leave a Reply