The strategic direction for Tesla’s next-generation artificial intelligence capabilities is becoming clearer with the anticipated debut of the Tesla AI6 chip. This groundbreaking silicon, set to be fabricated on Samsung’s advanced 2nm process node, is projected for initial deployment in the sophisticated Optimus Robot and the powerful Dojo Supercomputer clusters, rather than immediate integration into Tesla’s autonomous vehicles. This move signals a deliberate prioritization in the allocation of Tesla’s most cutting-edge AI chip technology.

This initial focus on Optimus and Dojo raises pertinent questions, especially given Elon Musk’s previous assertions regarding the standardization of a single AI chip across all of Tesla’s products, including cars. The decision suggests a phased rollout strategy, where the most demanding AI applications, such as the intricate movements of a humanoid robot and the massive data processing of a supercomputer, will benefit first from the enhanced processing power and efficiency of the Tesla AI6 chip.

Industry analysts anticipate mass production of the Tesla AI6 chip to commence by 2028, with peak output projected for the 2029-2032 period. This timeline makes it improbable that Tesla would invest significantly in designing an AI5 chip for cars only to transition rapidly to the 2nm Samsung AI6 a year later. Instead, existing Tesla vehicles, currently utilizing AI4 and AI5 chips, are likely to continue leveraging optimizations from the Dojo supercomputer for their Full Self-Driving algorithms, bridging the gap until the AI6 is ready for broader vehicle integration.

Tesla’s selection of Samsung for the production of its pivotal AI chip highlights a strategic decision driven by several factors. Beyond considerations of competitive pricing, Samsung’s substantial production capacity offers a critical advantage, ensuring the scale required for Tesla’s ambitious AI endeavors. Furthermore, the collaboration allows for co-development of the AI6 silicon, a unique opportunity that enables Tesla, and even Elon Musk personally, to engage directly in optimizing the production lines for efficiency and cost reduction.

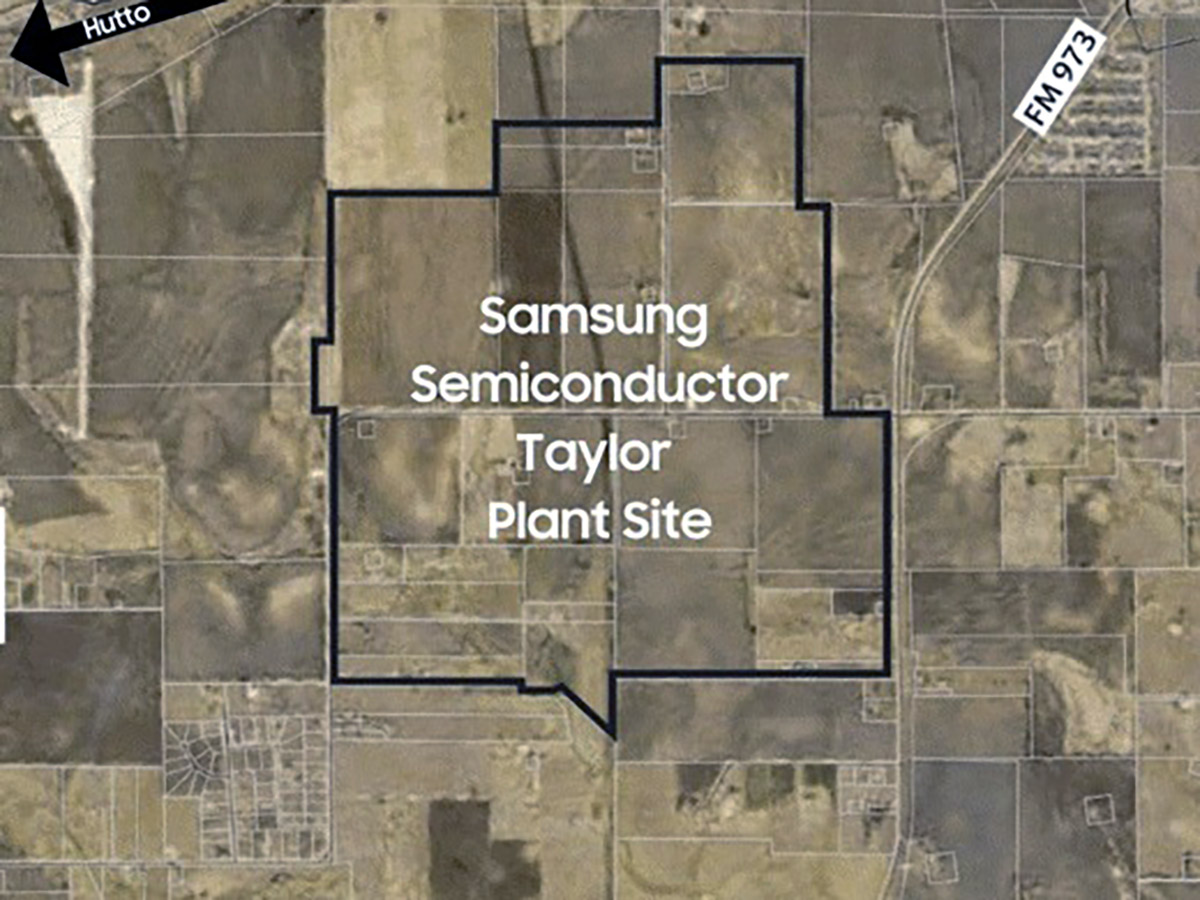

The pivot to Samsung and US-based manufacturing facilities, particularly the Taylor, TX foundry, also underscores Tesla’s calculated effort to mitigate geopolitical risks associated with semiconductor supply chains. This strategic shift from TSMC provides a hedge against potential global tensions and aligns Tesla with growing governmental emphasis on domestic manufacturing and supply chain resilience, ensuring a more secure and independent future for its critical AI chip components.

This broader strategy of supply chain diversification extends beyond semiconductors. Tesla is visibly shifting away from certain Chinese suppliers for crucial electric vehicle components, including batteries. For example, upcoming models are expected to feature LG ternary battery packs, which offer higher energy density and help circumvent potential tariffs or trade restrictions that might apply to Chinese-made cells, further solidifying the company’s move towards Korean suppliers.

Samsung’s commitment to the 2nm gate-all-around (GAA) production method has seen significant progress. While initial yield rates presented challenges, improvements have been substantial, with expectations to reach optimal levels at the Taylor foundry once new equipment is installed next year. The deal with Tesla is considered highly valuable for Samsung, as it not only secures a major client but also serves as a critical step in challenging TSMC’s long-standing dominance in advanced chip manufacturing processes within the semiconductor industry.

Ultimately, Tesla’s multi-billion-dollar AI chip agreement with Samsung represents a multifaceted strategic play. It is a testament to Tesla’s deep commitment to vertical integration and its unwavering focus on advancing autonomous technology. By securing a robust and geographically diversified supply chain for its most critical AI components, Tesla is positioning itself for sustained innovation and market leadership in the rapidly evolving landscape of artificial intelligence and advanced mobility.

Leave a Reply