Entegris (ENTG) shares experienced a significant downturn this week, plummeting by 14.46 percent to close at $79.34 apiece. This sharp decline reflects a strong investor reaction to the company’s recent earnings performance, which clearly disappointed market expectations despite a confident outlook provided for the current quarter. The Entegris stock movement highlights the volatile nature of the current market landscape, especially within the technology sector.

The financial report revealed a notable contraction in net income for Entegris, Inc. (NASDAQ:ENTG). In the second quarter, net income dropped by 22 percent, settling at $52.8 million compared to $67.7 million reported in the same period last year. This substantial decrease in profitability is a key factor contributing to the negative sentiment surrounding the ENTG earnings, raising concerns among shareholders about the company’s immediate financial health.

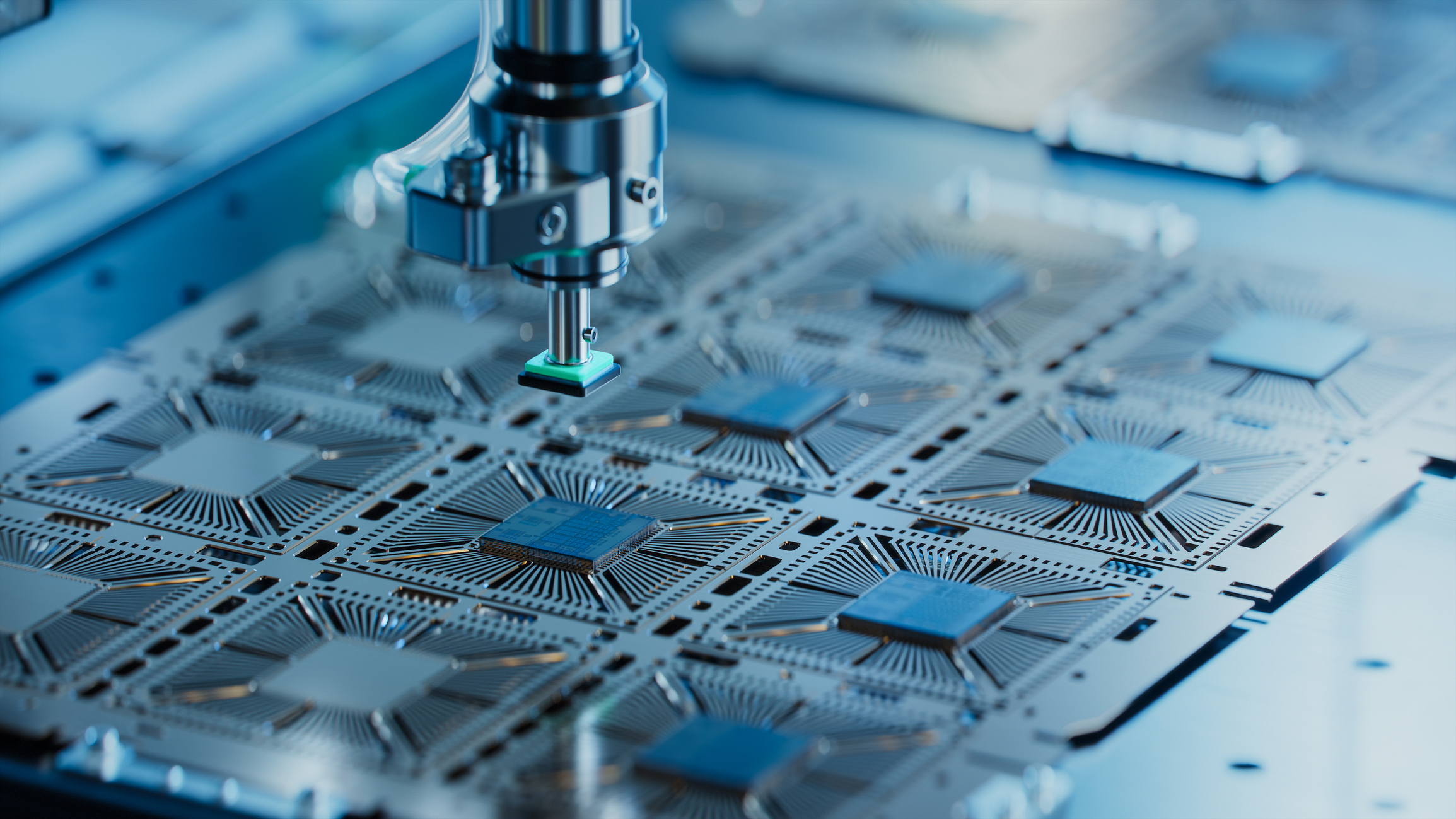

Addressing the company’s performance and the broader market, Entegris, Inc. President and CEO Bertrand Loy commented on the state of the semiconductor industry. He affirmed that overall industry trends remain largely consistent, with AI-enabled applications continuing to drive substantial growth, particularly in advanced logic and High Bandwidth Memory (HBM) segments. This positive aspect, however, is juxtaposed with other less favorable developments.

Despite the growth in AI-driven segments, Loy acknowledged that other areas of fabrication activity remain subdued. Furthermore, he highlighted that near-term challenges stemming from uncertainties around global trade policies and the wider macroeconomic environment are expected to continue influencing overall semiconductor demand. These external factors introduce a layer of complexity to the company’s operational outlook and contribute to market apprehension.

However, despite the immediate headwinds, Loy expressed unwavering optimism regarding the long-term trajectory of the industry and Entegris. He stated that the company’s confident long-term view of the market remains unchanged, underscoring a belief in sustained growth for both the semiconductor industry and Entegris itself. This long-term perspective aims to reassure investors amidst short-term volatility.

While the long-term vision offers a glimmer of hope, it is crucial for investors to acknowledge the inherent risks and the current potential of ENTG as an investment. The recent stock market analysis indicates that a singular focus on future projections might overlook present challenges. Diversifying portfolios and carefully evaluating investment opportunities remains paramount in a fluctuating market.

Our conviction suggests that certain AI investment opportunities may offer a more immediate and substantial return compared to traditional semiconductor plays like ENTG. For those seeking higher returns and a faster payoff, exploring other AI stocks with significant upside potential could be a more strategic approach in the current economic climate. This shift in focus reflects evolving market dynamics and investor priorities.

Leave a Reply