The European electronic component distribution market is currently navigating significant headwinds, primarily driven by a notable decline within the vital automotive sector. A recent comprehensive report from DMASS Europe, a leading industry body representing approximately 85% of the European components DTAM, sheds crucial light on this challenging landscape.

Data from DMASS reveals a substantial 14% fall in European semiconductor distribution sales during Q2 2025 compared to the same period in 2024. This downturn was felt across various nations, with Austria experiencing the most precipitous drop at 36.6%, followed by France with a 20% decrease. Germany and Ireland also reported significant contractions of 17% each, while the UK saw a 10.6% decline. Interestingly, Iberia defied the trend with a modest 2.4% increase, bringing the total European semiconductor market value to €2.22 billion by the end of Q2 2025.

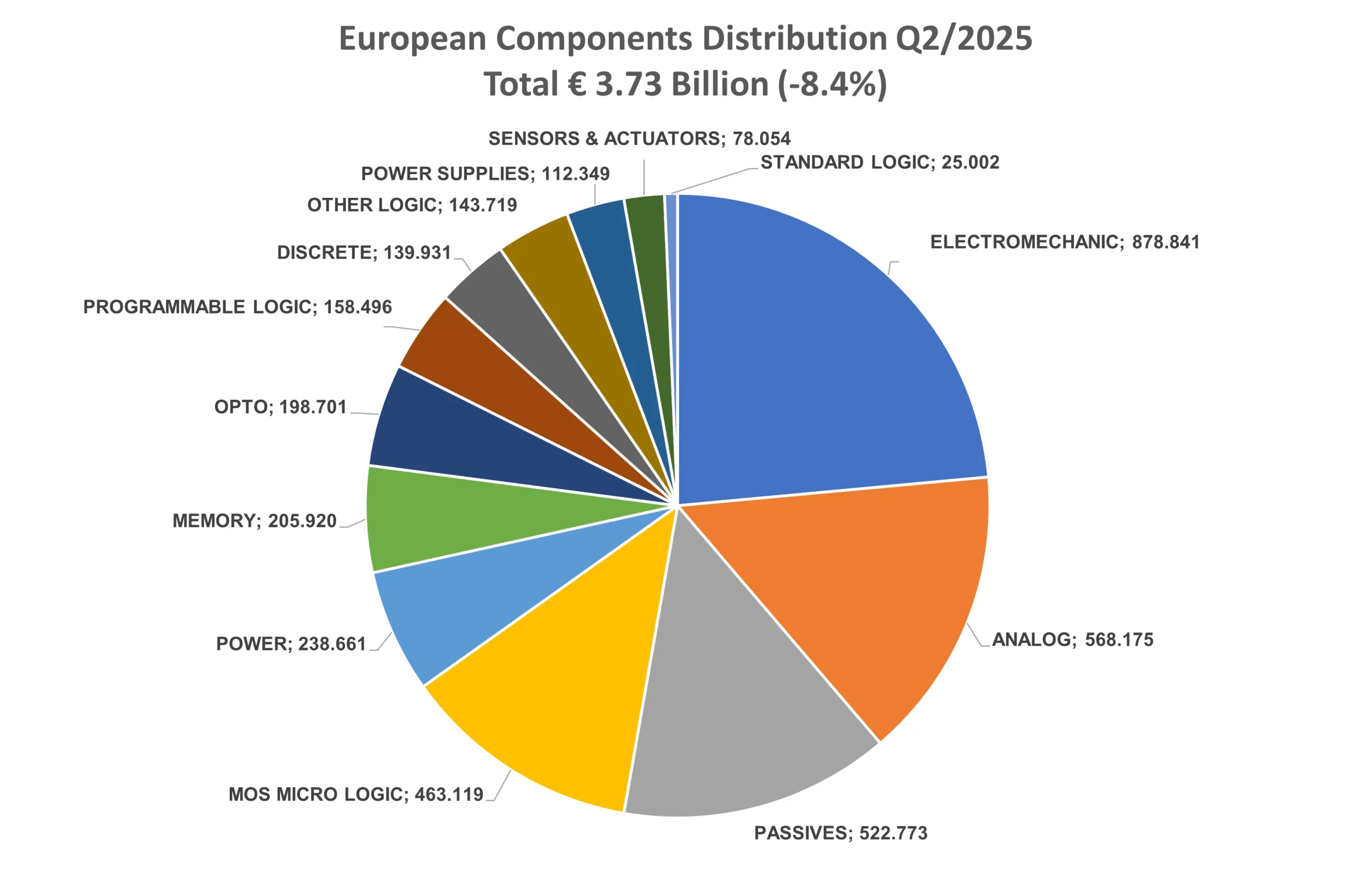

Specific product categories within semiconductors faced severe impacts, with power and programmable logic distribution sales recording the hardest hit, both declining by 21%. MOS micro logic sales shrank by 19%, analogue components by 15%, and memory sales by 13%. Opto-electronics also saw a 6% reduction. Conversely, some niches demonstrated resilience, with sensors and actuators witnessing a 6% rise and discrete distribution sales increasing by 1.6%, highlighting selective growth amidst broader market contraction.

The interconnect, passive, and electromechanical components (IP&E;) sector presented a more mixed picture, demonstrating an overall increase of 1.43% to reach a value of €1.51 billion. However, this growth was not uniform across the continent; Austria, the UK, Germany, and Switzerland all recorded declines of 7%, 3%, 4%, and 6% respectively in this segment.

Within the IP&E; market, several categories stood out with positive performance, notably circular connectors which soared by an impressive 122.7%. Power supplies also experienced a healthy rise of nearly 7%, electromechanical components grew by 2.3%, and sensors saw an increase of 7.6% compared to Q2 2024. In stark contrast, the capacitor market faced significant challenges, with film capacitors falling nearly 18%, tantalum capacitors dropping 11%, and aluminium capacitors declining by 10.5%.

Hermann Reiter, chairman of DMASS, acknowledged Europe’s underlying economic resilience but underscored the mounting pressure from broader global factors. He pointed to increasing geopolitical tensions and widespread global trade disruptions as key contributors to market instability. Reiter specifically cited extended lead times, significant inventory volatility, and a persistent dependence on critical raw materials sourced primarily from Asia as major strains on the already intricate supply chain.

Reiter further highlighted a crucial divergence in the international market dynamics. While the electronic components supply chain retains its global reach, customer markets are rapidly fragmenting. He contrasted the surging artificial intelligence (AI) demand observed in Asia and the United States with Europe’s current industrial stagnation, emphasizing the continent’s urgent need to strategically redefine its market position to counterbalance the significant drag from its declining automotive sector.

To address these challenges and remain competitive, Europe is actively responding with crucial strategies such as nearshoring initiatives, robust supply chain diversification efforts, and enhanced digital transparency measures. Reiter concluded by noting that the sustained demand for semiconductors, Internet of Things (IoT) devices, and advanced AI applications continues to fuel innovation, thereby presenting valuable growth opportunities even amidst the prevailing market uncertainty. He stressed that for Europe to thrive, it must more proactively shape these evolving global dynamics within the rapidly transforming electronics landscape.

Leave a Reply