The staggering growth of the United States’ federal debt has ignited urgent warnings from economic experts, who label its current trajectory as fundamentally unsustainable and a significant threat to the nation’s financial stability. Federal Reserve Chairman Jerome Powell has candidly stated that the nation’s fiscal path is perilous, underscoring a widespread uncertainty regarding how much further this colossal borrowing can continue before critical repercussions materialize. This mounting federal debt is not merely an abstract figure; it represents a profound challenge to America’s future prosperity.

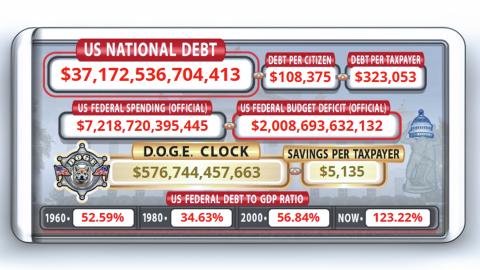

Chris Edwards, a seasoned economist at the Cato Institute, paints a grim picture of the current economic crisis, asserting that the United States finds itself in an “extremely serious and dangerous situation.” He highlights the alarming escalation, noting that the national debt has already surged past an unprecedented $30 trillion. Projections from Washington’s financial accountants indicate an even more dramatic rise, estimating that without substantial fiscal policy changes, this figure could balloon to an astounding $50 trillion within the coming years, placing immense pressure on the US economy.

Despite these dire warnings, the immediate impact of this monumental national debt has been partially mitigated by the continuous global appetite for U.S. Treasury notes, which effectively finances the nation’s borrowing habits. This sustained demand, particularly from major foreign holders like Japan and China, has led some financial figures to downplay the severity of the situation. For instance, “Big Short” investor Steven Eisman contends that the federal debt remains a non-issue, primarily because no viable alternative to U.S. treasuries currently exists on a comparable scale.

Eisman’s perspective, while offering a degree of reassurance, also inadvertently highlights a critical vulnerability within the US economy. The stability afforded by global reliance on U.S. treasuries could evaporate if a credible alternative were to emerge. More critically, the geopolitical implications of such dependence cannot be overstated. A hypothetical scenario, such as China deciding to divest its substantial holdings of U.S. treasury notes during a future conflict, could trigger a precipitous decline in the dollar’s value and unleash rampant inflation across the nation, severely impacting purchasing power.

Even without such a dramatic international incident, the burgeoning federal debt is already exerting a tangible, negative influence on American households. The ongoing accumulation of debt contributes to a gradual erosion of wealth, subtly making citizens poorer over time. Economic analyses suggest that if current trends persist, the compounding effect of this government spending could cost the average American as much as $14,000 annually in lost income by 2054, a staggering long-term financial burden that will directly impact future generations.

The intergenerational inequity inherent in this fiscal policy is a focal point for many lawmakers. Senator Ron Johnson (R-WI) has vehemently articulated this concern, stating that the nation is effectively “mortgaging our children’s future.” He deems this practice “wrong, immoral, and something that has to stop,” emphasizing the ethical imperative to address the national debt before it irreparably harms subsequent generations. This sentiment underscores a growing bipartisan unease regarding the long-term implications of unchecked government spending.

Similarly, Representative Chip Roy (R-TX) has sharply criticized the nation’s current fiscal policy, asserting that “we are writing checks we cannot cash, and our children are going to pay the price.” His statement encapsulates the frustration felt by many who witness the escalating national debt without corresponding concrete action. While there is broad consensus across the political spectrum in Washington regarding the urgent need to curtail the federal debt, the critical challenge lies in mustering the requisite political will to implement the difficult decisions necessary for meaningful change.

The chasm between acknowledging the problem and enacting effective solutions remains vast, hindering genuine progress on debt reduction. This persistent gridlock means that despite the grave warnings from economists and politicians alike, the US economy continues on a path that many consider unsustainable. Addressing this deep-seated issue requires a concerted effort to reform government spending and fiscal policy, ensuring a more secure and prosperous future for all Americans, rather than burdening future generations with an insurmountable debt.

Leave a Reply