In the dynamic realm of the artificial intelligence market, few figures command as much attention and respect as Broadcom Inc.’s CEO, Hock Tan, particularly in the eyes of prominent financial commentator Jim Cramer.

Jim Cramer, known for his incisive market analysis, has consistently championed Broadcom (NASDAQ:AVGO), positioning it as a top-tier contender within the competitive chip sector. While his recent morning appearances might not feature the company as frequently, Cramer’s unwavering conviction in AVGO underscores its foundational strength and strategic importance in the tech landscape.

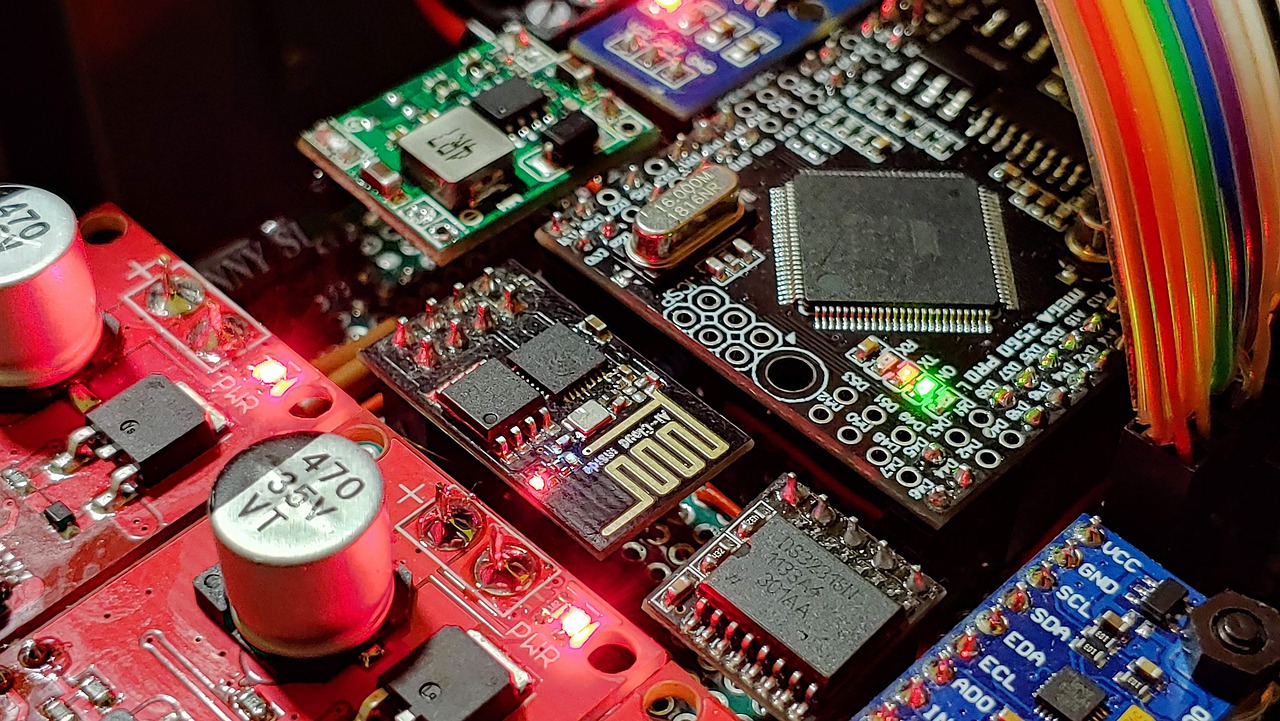

Broadcom’s ascendance in today’s AI-driven economy is largely attributed to its crucial role in designing advanced chips. These innovations are instrumental in alleviating the significant global shortage of high-demand AI GPUs, notably those from industry leaders like NVIDIA, thereby solidifying Broadcom’s indispensable position.

Cramer’s admiration for Hock Tan goes beyond just corporate performance; he vividly describes Tan as a “tough guy,” a descriptor that, in Cramer’s view, speaks volumes about his effectiveness in an industry often characterized by intense competition and rapid technological shifts. This formidable leadership style, Cramer suggests, is precisely why Tan remains remarkably underestimated by many.

Indeed, the financial markets reflect Tan’s profound impact, with Broadcom experiencing substantial gains. This impressive market performance is a direct testament to Tan’s astute leadership, his strategic acumen, and his ability to navigate complex market dynamics to drive the company’s continued growth and innovation.

While the investment landscape for companies like Broadcom (AVGO) naturally encompasses a spectrum of both risks and significant potential, the current market narrative increasingly points towards the transformative power of artificial intelligence. Many analysts and investors are now looking beyond traditional metrics, recognizing that certain AI-centric stocks are poised for unprecedented returns.

The collective belief in the market is shifting towards AI innovations that promise not only higher returns but also a more accelerated timeline for capital appreciation. This outlook underscores the unique opportunities present within the AI sector, differentiating it from conventional investment avenues.

Ultimately, Broadcom’s strategic prowess under Hock Tan’s guidance positions it as a formidable force in the semiconductor world. Its consistent innovation in the AI chip domain, coupled with a leadership style admired by figures like Jim Cramer, ensures its enduring relevance and potential for continued market impact.

Leave a Reply