Investors are keenly awaiting Liberty Global’s upcoming quarterly earnings report, set to be released on Friday, August 1, 2025. This pivotal announcement will provide crucial insights into the company’s financial health and strategic direction, shaping the broader Liberty Global Stock narrative and guiding future investment decisions. Understanding the nuances of this report is essential for anyone following the Telecom Industry Analysis.

Analysts have set the earnings per share (EPS) estimate for Liberty Global at $-0.55. Beyond merely hitting or missing this figure, market observers will be particularly attentive to the company’s forward guidance. Positive growth forecasts for the next quarter are often more influential than the immediate EPS result, driving significant shifts in LBTYA Earnings sentiment and market valuation.

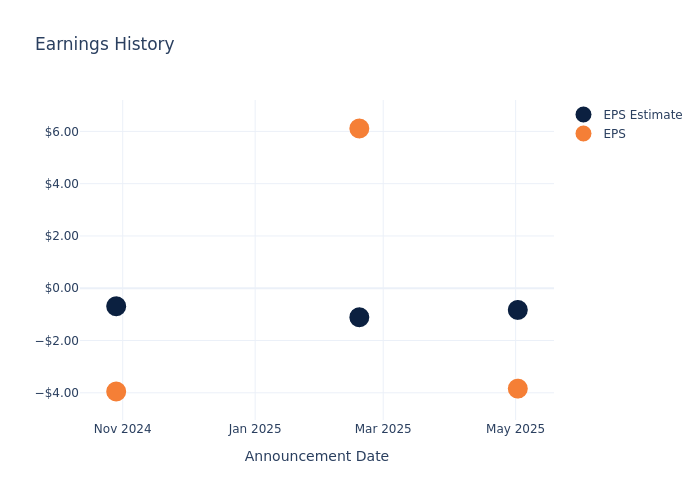

Historically, Liberty Global’s past earnings releases have sometimes presented mixed results. For instance, the company missed its EPS by $3.01 in the previous quarter, though this led to a relatively flat share price movement in the subsequent trading session. Examining the full earnings track record provides a broader context for anticipating how the market might react to the impending announcement.

As of July 30, shares of Liberty Global Stock were trading at $9.86, reflecting a 2.68% increase over the last 52 weeks. This generally positive trajectory suggests a bullish sentiment among long-term shareholders, indicating confidence in the company’s sustained performance leading into this earnings period. The overall Stock Market News for LBTYA has been encouraging.

A critical component of any comprehensive Investor Outlook involves evaluating analyst sentiments. Liberty Global currently holds a consensus “Neutral” rating from analysts, based on three individual ratings. The average one-year price target of $10.87 signals a potential upside of 10.24%, offering a glimpse into professional expectations for the company’s future valuation and growth potential.

When compared to its industry peers, Liberty Global occupies a middle position in terms of consensus ratings. While it lags in revenue growth, signifying slower expansion relative to competitors, the company excels in gross profit, demonstrating robust profitability. However, its lower return on equity (ROE) suggests a less efficient utilization of shareholder capital compared to some counterparts, impacting its overall Financial Performance.

Liberty Global, a significant holding company, boasts substantial interests in leading European telecom entities across key markets like the UK, Netherlands, Belgium, Ireland, and Slovakia. Its strategic approach since 2016 has focused on merging or partnering with mobile network operators to offer integrated converged services, a pivotal move in the evolving global Telecom Industry Analysis. The company also maintains minority stakes in various media, entertainment, and cloud ventures.

The company’s market capitalization notably surpasses industry averages, underscoring its dominant scale within its sector and solidifying its robust market position. Furthermore, Liberty Global has demonstrated impressive revenue growth, with a significant increase by March 31, 2025, outperforming the average growth rate within the Communication Services sector, highlighting its top-line strength. Its ROE also exceeds industry standards, showcasing exceptional efficiency in leveraging shareholder equity. While its return on assets (ROA) is below average, indicating some challenges in asset utilization, the overall picture of Financial Performance remains strong.

For investors navigating the complexities of the current market, a deep dive into these fundamental metrics provides a clearer picture of Liberty Global’s standing. The impending earnings report will serve as a critical update, offering further clarity on its financial trajectory and market impact.

Leave a Reply