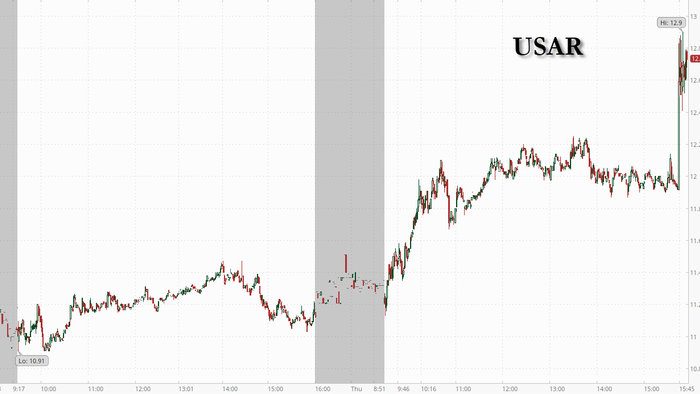

The Trump administration has significantly expanded its support for the domestic rare earth industry, broadening a crucial policy beyond its initial focus on MP Materials. This strategic move, aimed at bolstering U.S. critical minerals production, has already sent shares of companies like USA Rare Earth rocketing higher, underscoring the market’s positive reaction to increased government backing in this vital sector.

This expanded policy introduces guaranteed price floors for key rare earth elements, a mechanism designed to drastically reduce the investment risks that have historically deterred private capital from entering the U.S. mining and refining landscape. The approach directly mirrors the successful strategy implemented earlier this year with MP Materials, where substantial government involvement catalyzed market confidence and secured a long-term domestic supply chain.

Top White House officials, including President Donald Trump’s trade advisor Peter Navarro and National Security Council supply chain official David Copley, conveyed to rare earth companies that the administration is pursuing a comprehensive, pandemic-style strategy. This initiative aims to strengthen U.S. critical minerals production and directly counter China’s entrenched market dominance by establishing guaranteed minimum prices for American-produced rare earth products.

A previously unreported meeting on July 24 highlighted the broad scope of this initiative, bringing together ten rare earth firms alongside major technology giants such as Apple, Microsoft, and Corning. These tech powerhouses are critically dependent on reliable supplies of these essential minerals for their electronics manufacturing, emphasizing the cross-industry importance of securing a robust domestic supply.

The precedent for this groundbreaking policy was set in July when the Pentagon made an unprecedented $400 million equity investment in MP Materials, which operates the Mountain Pass rare earth mine in California. This pivotal deal established the Department of Defense as MP’s largest shareholder and locked in a 10-year price floor for neodymium-praseodymium oxide, nearly doubling prevailing Chinese spot prices and demonstrating a strong commitment to domestic strategic metals production.

The market’s response to MP Materials’ initial government backing was immediate and dramatic, with shares surging over 50% on the announcement day as investors factored in the guaranteed revenue and governmental support. Further rallies followed, propelled by supply deals with major tech firms like Apple, ultimately pushing the company’s market capitalization towards $9.5 billion and showcasing the transformative power of strategic government intervention in the critical minerals sector.

Navarro and Copley explicitly stated that the price floor arrangement granted to MP Materials was not a “one-off” and that similar agreements were actively being developed for other domestic rare earth companies. This commitment reflects years of advocacy from U.S. critical minerals producers, who have consistently argued that China’s overwhelming market dominance stifles investment in American mining projects, thereby necessitating federally backed price guarantees to mitigate risk and foster growth.

Rare earths, a group of 17 metals, are indispensable for manufacturing the powerful magnets that convert power into motion, making them essential components in a vast array of modern electronics, from smartphones to advanced military hardware. This policy expansion signals a significant escalation in the U.S. effort to secure its supply chains for these vital strategic metals, aiming to reduce reliance on foreign sources and strengthen American technological independence.

The administration’s broadened support marks a pivotal moment for the U.S. rare earth industry, promising to unlock new investment and accelerate the development of a resilient domestic supply chain. This strategic pivot is poised to reshape the global landscape of critical minerals, solidifying America’s position in an increasingly competitive technological and geopolitical arena.

Leave a Reply