The intricate web of global trade policies is once again sending ripples through the automotive industry, with a particular focus on the significant financial burden faced by American manufacturers. Ford, a cornerstone of U.S. industrial might, is grappling with an estimated $2 billion setback directly attributed to the ongoing impact of the Trump administration’s tariffs, creating a stark competitive disadvantage against its international rivals.

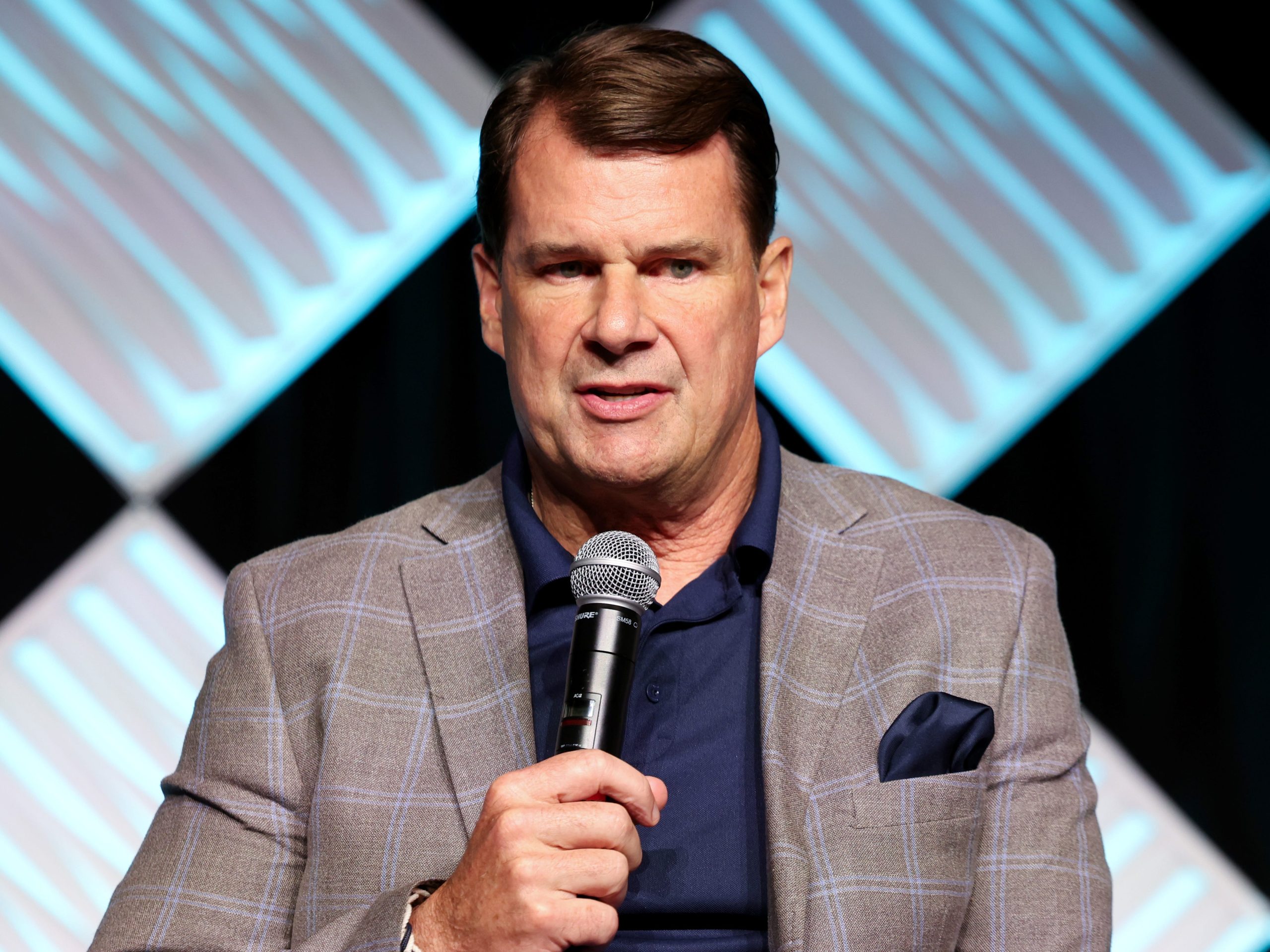

This substantial financial hit was revealed by Ford CEO Jim Farley, who highlighted the escalating costs during a recent earnings call. The initial projections of a $1.5 billion tariff impact have now been surpassed, underscoring the deep and persistent economic challenges posed by the current trade landscape for the company’s bottom line.

Farley painted a vivid picture of the disparities emerging from these auto tariffs, noting that a Toyota 4Runner, manufactured in Japan, could cost consumers an astonishing $10,000 less than a Michigan-made Ford Bronco. Similarly, a Kentucky-built Ford Escape might see its price inflated by $5,000 compared to a Japanese-produced Toyota RAV4, directly impacting sales competitiveness.

Beyond the immediate financial figures, Farley elaborated on a fundamental shift in the global automotive industry towards a more regionalized business model. He cited not only the Trump administration’s trade policies but also the accelerating adoption of electric vehicles and evolving carbon regulations as key drivers compelling this strategic pivot.

The Ford CEO further clarified that a recent reduction in tariffs on Japan by the Trump administration inadvertently amplifies this cost advantage for Asian competitors, giving them a “meaningful” edge in critical markets. This nuanced aspect of trade policy underscores the complex and often unpredictable outcomes of international economic decisions.

Farley’s concerns about the detrimental effects of tariffs are not new. He has consistently voiced apprehension regarding the economic impact of such measures, previously warning that extended tariffs on Canada and Mexico had already provided a “windfall” for South Korean and Japanese auto companies, indicating a prolonged struggle for Ford.

Despite Ford’s proactive engagement with the Trump administration to mitigate its tariff expenses and enhance its competitive standing, the market’s response has been palpable. Following these financial disclosures, Ford’s shares experienced a nearly 1.6% decline in after-hours trading, reflecting investor anxiety over the persistent US manufacturing challenges.

This ongoing saga highlights the delicate balance between national trade interests and the intricate realities of global supply chains and manufacturing costs. For Ford, navigating these headwinds means confronting direct competitive disadvantages that could reshape consumer choices and market dynamics in the long term, pushing for innovations and strategic adjustments.

Leave a Reply